Saturday, 3 October 2009

Charlotte's Joke!

Barrack Obama came into office. A week later- Swine Flu!

You have 2 cows.

You give one to your neighbour.

COMMUNISM

You have 2 cows.

The State takes both and gives you some milk.

FASCISM

You have 2 cows.

The State takes both and sells you some milk.

NAZISM

You have 2 cows.

The State takes both and shoots you.

BUREAUCRATISM

You have 2 cows.

The State takes both, shoots one, milks the other, and then throws the milk away.

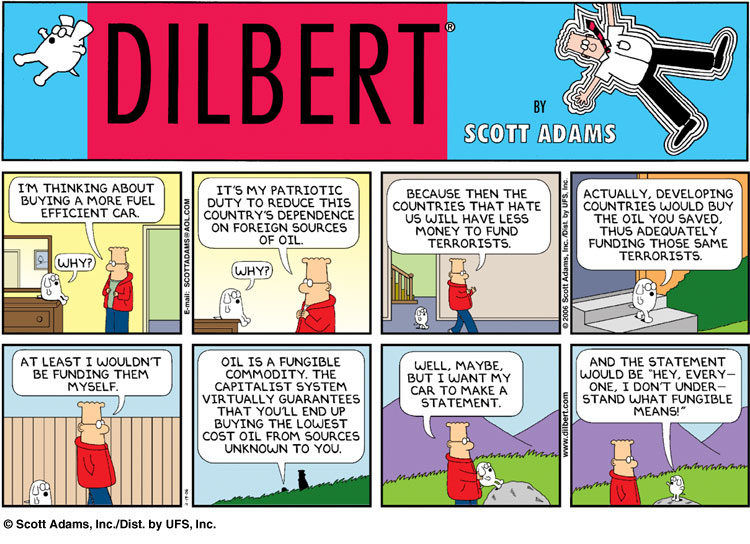

TRADITIONAL CAPITALISM

You have two cows.

You sell one and buy a bull.

Your herd multiplies, and the economy grows.

You sell them and retire on the income. (Hah!)

ROYAL BANK OF SCOTLAND (VENTURE) CAPITALISM

You have two cows.

You sell three of them to your publicly listed company, using letters of credit opened by your brother-in-law at the bank, then execute a debt/equity swap with an associated general offer so that you get all four cows back, with a tax exemption for five cows.

The milk rights of the six cows are transferred via an intermediary to a Cayman Island Company secretly owned by the majority shareholder who sells the rights to all seven cows back to your listed company.

The annual report says the company owns eight cows, with an option on one more.

You sell one cow to buy a new president of the United States , leaving you with nine cows.

No balance sheet provided with the release.

The public then buys your bull.

AN AMERICAN CORPORATION

You have two cows.

You sell one, and force the other to produce the milk of four cows.

Later, you hire a consultant to analyze why the cow has dropped dead.

A FRENCH CORPORATION

You have two cows.

You go on strike, organize a riot, and block the roads, because you want three cows.

A JAPANESE CORPORATION

You have two cows.

You redesign them so they are one-tenth the size of an ordinary cow and produce twenty times the milk.

You then create a clever cow cartoon image called 'Cowkimon' and market it worldwide.

AN ITALIAN CORPORATION

You have two cows, but you don't know where they are.

You decide to have lunch.

A SWISS CORPORATION

You have 5000 cows. None of them belong to you.

You charge the owners for storing them.

A CHINESE CORPORATION

You have two cows.

You have 300 people milking them.

You claim that you have full employment, and high bovine productivity.

You arrest the newsman who reported the real situation.

AN INDIAN CORPORATION

You have two cows.

You worship them.

A BRITISH CORPORATION

You have two cows.

Both are mad.

AN IRAQI CORPORATION

Everyone thinks you have lots of cows.

You tell them that you have none.

No-one believes you, so they bomb the crap out of you and invade your country.

You still have no cows, but at least you are now a Democracy.

AN AUSTRALIAN CORPORATION

You have two cows.

Business seems pretty good.

You close the office and go for a few beers to celebrate.

A NEW ZEALAND CORPORATION

You have two cows.

The one on the left looks very attractive

Friday, 25 September 2009

Saturday, 5 September 2009

Friday, 17 July 2009

Friday, 5 June 2009

Outside Bristol Zoo is the car park, with spaces for 150 cars and 8 coaches. It has been manned 6 days a week for 23 years by the same charming and very polite car park attendant with the ticket machine. The charges are £1. per car and £5 per coach.

On Monday 1 June, he did not turn up for work. Bristol Zoo management phoned Bristol City Council to ask them to send a replacement parking attendant.The Council said "That car park is your responsibility." The Zoo said "The attendant was employed by the City Council... wasn't he?" The Council said "What attendant?" Gone missing from his home is a man who has been taking daily the car park fees amounting to about £400. per day for the last 23 years...!I make that about £2.7 million !

Quite possibly the most sensible way to stimulate growth!

Latvians may be feeling depressed as a result of the economic crisis which has hammered the Baltic state, but over 500 blonde women did their best to lift spirits in Riga on Sunday with a parade and other "Blonde Weekend" events.

The global economic crisis has hit the Baltic state of Latviaparticularly hard and left the population feeling blue. But one group of Latvian women has taken a novel approach to fighting the pervasive feeling of doom and gloom.

On Sunday, a procession of more than 500 blondes paraded through the capital Riga wearing pink and white. Many were escorted by lap dogs wearing the same cheerful hues. Their goal: to use their beauty to shine a little light into the dark mood caused by the global downturn.

Though it was far from being a protest march, some women used the opportunity to counter stereotypes. "I am beautiful, but I'm not dumb," Ilone Zigure told the news agency AFP. The student added that she hopes that those of her countrymen who are depressed about the economic crisis will find her "positive energy" contagious.

It's a sentiment that many observing the parade shared. "Finally, something positive," one 70-year-old woman watching the parade told AFP. "I just can't stand listening to people talk about the crisis anymore."

The parade was just part of a range of events making up Riga's "Blonde Weekend," which also included a golf tournament, a fashion show, a ball and a drawing contest for kids. TheLatvian Blondes Association, which organized the events, hoped to use any proceeds from the weekend's activities toward a playground for handicapped children.

Tuesday, 2 June 2009

Good old Bill Kenwright (Chairman of Everton FC)

What A Lovely Man Bill Kenwright Is

Now, before I start, I'm a Liverpool fan.

However, my mum's boss is an Evertonian (no one's perfect eh?), now with his team getting to the Cup final this year he was hoping against hope he could take his young lad to the final and so called to book tickets on the day they became available, the lady at the ticket office takes his credit card details and says he has two tickets for the game - up in the gods, but still, he would get to take his son to Wembley to watch his team - a special day out (especially as they don't get there very often eh?).

So, last week comes around but still no sign of the magical tickets - so my mums boss (we'll call him Simon...because that's his name) rings the club to ask what's going on, should he come and pick them up? Only to be told (4 days before the final) that no, he doesn't have tickets!

You can imagine how annoyed he must have been!! So he sits down at his desk and writes the strongest of strongly worded emails to all and sundry (including the Everton supporters club apparently). Thursday afternoon the office phone rings and Simon picks up the phone (they're solicitors so sitting round doing nothing is their idea of hard work) - its only Bill Kenwright!

"Hi Simon, I have seen your email and I'm sorry you have had such a hard time about the tickets - its unacceptable that you should be told you would have the tickets and then not get them and not get told until a few days before the game, I'd like to offer you 4 tickets, pitchside, right next to the tunnel to make it up to you!"

Now I know football these days is all about money (they are businesses after all) but I thought this was a really nice touch, and I can hardly imagine Roman (or many of the other premier league chairmen...sorry, chair-people) doing something similar.

So nice one Bill - you went someway to restoring my faith in there being at least some decent people left in the game and even though you lost, you made Simons young lads year (probably decade judging by their ability to get to major cup finals)!

Monday, 1 June 2009

Market manipulation, short-covering rallies and cyclical bulls

There has been a lot of chatter in the markets about why U.S. equities continue to rally. Three distinct viewpoints have surfaced, two of which are bearish and one which is bullish. Let me share those theories with you.

1. Market Manipulation aka. the Plunge Protection Team

In this storyline, someone (probably the famed Plunge Protection Team) is manipulating the market to push it higher. Michael Panzner pointed out this view last Friday in a post called “Manipulation, Anyone? Now, Michael’s site is called Financial Armageddon, so you know he’s bearish and the post reflects this.

Coming as it did on the last day of the week at the end of a month, some might find the action that took place near today’s close to be rather interesting.

From 3:54:28 pm to 4:00:02 pm, S&P 500 e-mini futures rallied 17.25 points on approximate volume of 356,300 contracts, or 19.3% of the total turnover from 9:30 a.m. until futures finished trading at 4:15 p.m.

Hmmm. Manipulation, anyone?

2. Short-covering rally

But, while Panzner thinks outright manipulation is to blame, he is not alone in seeing this upward move as suspicious. Others point to technical factors as responsible for why the market(s) is rallying (It is not just the U.S. - as I write this the Dax has rallied 4% AND the S&P 500 is up over 2%). Yves Smith pointed out a post over at the Market Ticker which sees short covering as very much a factor in Friday’s late-day rally.

What does this all mean? A few things:

The stops up there are gone. They were potential rocket fuel for next week and the propellant to take us to - and potentially through - the 200DMA on the cash.

A bunch of someones had a lot of contracts that were short taken out on them. Those nearly 250,000 E-mini contracts did change hands, and odds are a very large percentage of them constituted stop-loss orders on contracts sold short from when we were up toward 933 a few weeks ago. Those traders are going to be quite pissed off, but that’s the risk of the game.

Next week is very likely to be extraordinarily violent, especially Monday. /ZN (10 year Treasury futures) has seen an insane drop in open interest over the last few weeks. This little game undoubtedly severely damaged open interest in the E-Mini /ES contract.

Thin markets are dangerous markets. While the E-Mini still is very liquid, the removal of these stops from the order book leaves the door open for both little resistance if the market decides to move higher early next week, and also provides the potential for irritated shorts to re-establish their positions short, driving the market lower. Those who wound up long during that little ramp job are likely to be rather nervous as well.

For my part I shorted that spike. Not large, and I am fully prepared to hedge it Sunday evening if necessary or just take it down, as there is every possibility, this close to the 200MA, that we will at least hit it on the cash, and blowing through it on volume and continuing higher cannot be ruled out.

I will note, however, that the last time we saw this sort of dislocation activity start up into the close it it too began with these sorts of “rocket shot” moves higher - and once the shorts were all blown out by having their stops run, the market essentially pancaked.

Look sharp - the sharks are in the water and you taste good.

For those of you who need a translation of what this means, I would say this: someone who was short had to liquidate a very large position due to a margin call and this forced the market up. In fact, many people believe (Meredith Whitney included) that much of the recent rally has nothing to do with fundamentals and is a short-covering rally plain and simple. Even so, it is a powerful rally nonetheless, and the shorts are getting killed.

3. Bull-Market/Secular Bear Market Rally

Then there is the bullish view. This view sees the market rally as a real bull market based on the potential for economic recovery sometime in the second half of 2009. Some think this is a secular bull – a view I am not discussing in this post. Others see this as a cyclical bull-market a.k.a bear market rally I would put Jeremy Grantham in this category. I would also put myself here, although I do think short-covering has made this rally dangerously over-bought. Paul Kedrosky recently made the bear market rally story very well in an interview with Tech Ticker’s Aaron Task (see the attached video as well).

Kedrosky thinks the S&P could approach 1100 by year-end, which would translate into the Dow well above 10,000.

Nonetheless, he believes it’s a bear market rally and unlikely to continue into 2010 as the market to get hit by fears of a “double-dip” recession.

How long the rally last is dependent on how long authorities can prop up the economy artificially. Remember the huge rally from 2002-2007 that took the Dow and S&P to new highs? That was a very long bear market rally. So, it is not altogether clear where the market is headed over the medium term. In my view, the U.S.market is going to eventually re-test its 2009 lows (which are 14 year lows when adjusted for inflation).

For now, there are enough doubters about how ‘real’ this rally is to provide road kill for the uptrend, making the kick up that much more powerful. Witness today’s breathtaking surge to the upside. When and whether systemic weakness re-asserts itself is another question altogether. For now, the bulls have gained hold.

Thursday, 28 May 2009

Breaking News - Burglary at Stamford Bridge

Metropolitan Chief of Police asked Guus Hiddink if any cups were stolen.....

"We're not sure" replied Guus "We haven't checked the canteen yet"

Boom Tish !!!!!

U.S. Inflation to Approach Zimbabwe Level, Faber Says

From Bloomberg:

May 27 (Bloomberg) -- The U.S. economy will enter “hyperinflation” approaching the levels in Zimbabwe because the Federal Reserve will be reluctant to raise interest rates, investor Marc Faber said.

Prices may increase at rates “close to” Zimbabwe’s gains, Faber said in an interview with Bloomberg Television in Hong Kong. Zimbabwe’s inflation rate reached 231 million percent in July, the last annual rate published by the statistics office.

“I am 100 percent sure that the U.S. will go into hyperinflation,” Faber said. “The problem with government debt growing so much is that when the time will come and the Fed should increase interest rates, they will be very reluctant to do so and so inflation will start to accelerate.”

Federal Reserve Bank of Philadelphia President Charles Plosser said on May 21 inflation may rise to 2.5 percent in 2011. That exceeds the central bank officials’ long-run preferred range of 1.7 percent to 2 percent and contrasts with the concerns of some officials and economists that the economic slump may provoke a broad decline in prices.

“There are some concerns of a risk from inflation from all the liquidity injected into the banking system but it’s not an immediate threat right now given all the excess capacity in the U.S. economy,” said David Cohen, head of Asian economic forecasting at Action Economics in Singapore. “I have a little more confidence that the Fed has an exit strategy for draining all the liquidity at the appropriate time.”

Action Economics is predicting inflation of minus 0.4 percent in the U.S. this year, with prices increasing by 1.8 percent and 2 percent in 2010 and 2011, respectively, Cohen said.

Near Zero

The U.S.’s main interest rate may need to stay near zero for several years given the recession’s depth and forecasts that unemployment will reach 9 percent or higher, Glenn Rudebusch, associate director of research at the Federal Reserve Bank of San Francisco, said yesterday.

Members of the rate-setting Federal Open Market Committee have held the federal funds rate, the overnight lending rate between banks, in a range of zero to 0.25 percent since December to revive lending and end the worst recession in 50 years.

The global economy won’t return to the “prosperity” of 2006 and 2007 even as it rebounds from a recession, Faber said.

Equities in the U.S. won’t fall to new lows, helped by increased money supply, he said. Still, global stocks are “rather overbought” and are “not cheap,” Faber added.

Faber still favors Asian stocks relative to U.S. government bonds and said Japanese equities may outperform many other markets over a five-year period. “Of all the regions in the world, Asia is still the most attractive by far,” he said.

Gloom, Doom

Faber, the publisher of the Gloom, Boom & Doom report, said on April 7 stocks could fall as much as 10 percent before resuming gains. The Standard & Poor’s 500 Index has since climbed 9 percent.

Faber, who said he’s adding to his gold investments, advised buying the precious metal at the start of its eight-year rally, when it traded for less than $300 an ounce. The metal topped $1,000 last year and traded at $949.85 an ounce at 12:50 p.m. Hong Kong time. He also told investors to bail out of U.S. stocks a week before the so-called Black Monday crash in 1987, according to his Web site.

Tuesday, 26 May 2009

Navigating the Natural Resource Curse

By DWYER GUNN

When oil was discovered in 2007 off the shores of small, sturdy Ghana, the country’s government officials called the discovery “perhaps the greatest managerial challenge” the country had faced since independence. John Kufuor, Ghana’s president at the time, warned that “instead of a being a blessing, oil sometimes proves the undoing of many … nations who come by this precious commodity.”

Ghana’s reaction no doubt surprised oil-starved observers in developed countries, but the Ghanaian officials were referring to the “resource curse” that has wreaked havoc in other resource-rich, developing countries. Natural-resource wealth not only increases civil violence but, in a bizarre development paradox, is linked to lower economic growth.

In The Bottom Billion, the economist Paul Collier cites three reasons why resource wealth results in low levels of economic growth. First, the discovery and extraction of natural resources can lead to the crowding out of other sectors, otherwise known as “Dutch Disease.” The booming natural resource sector draws labor and capital away from other areas, and the natural-resource revenues result in a stronger exchange rate, reducing the competitiveness of non-resource exports.

Second, commodity price volatility enables boom and bust spending cycles characterized by poor investments and irresponsible spending. Collier writes that during an asset-price bubble in Kenya, “one ministry raised its proposed budget thirteenfold and refused to prioritize.”

Finally, Collier argues that resource revenues can cause deterioration in governance and public institutions through a variety of channels. Bribery becomes a more efficient means of obtaining votes than the delivery of public services. Citizens paying low taxes thanks to resource revenues are less likely to scrutinize their leaders.

Last week, the Natural Resource Charter was launched in Oslo. Developed by a group of economists including Collier and Nobel Laureate Mike Spence, the charter is “a set of economic principles for governments and societies on how to use the opportunities created by natural resources effectively for development.” Essentially, the charter tells countries how to avoid the resource trap.

Will a charter actually do anything? There might be some lessons gleaned from the experience of the Extractive Industries Transparency Initiative (EITI), which was proposed by the British government in 2002 and is now widely supported by governments and industries.

Resource-rich governments that commit to the EITI agree to implement increased transparency measures. The EITI board announced this week that Albania, Burkina Faso, Mozambique, and Zambia will join the 26 candidate countries already committed to implementing the EITI protocols. The jury is still out on the effectiveness of the EITI in candidate countries, but preliminary results are encouraging.

Perhaps more importantly, the EITI is already shifting attitudes in resource-rich developing countries. Collier writes of sitting in a meeting of West African ministers as they discussed resource-revenue governance. The EITI served as a concrete rallying point for both reformist countries and for reformers in reluctant countries. Collier writes, “An international charter gives people something very concrete to demand: either the government adopts it or it must explain why it won’t.”

Link

Friday, 15 May 2009

Report from the EGM - Thursday 14th May 2009

1. Opening of the Extraordinary General Meeting of Shareholders and Announcements

2. The Managing Board's and Supervisory Board's assessment of recent corporate developments and strategic options

3. A.O.B.

Minutes:

Due to his sterling work and dedication, it was agreed that the Social Secretary shall in future carry the title of Social Chairman. It was noted by the meeting that the Social Chairman had been using this title for some time prior to the meeting.

The appointment of, and subsequent removal of the post of Vice Chair to Jerome was discussed at length. It was felt by the meeting that whilst he possesses the necessary qualities and experience for the position, that neither the Shareholders nor Officers had benefited yet from his expertise. Therefore confirmation of his re-appointment can only be made following clear evidence of his commitment to the position.

The meeting was then privy to a number of highly confidential and sensitive presentations from officers and shareholders alike. Commercial and legal sensitivities do not permit publication here. However full briefings are available from the Chairman and Social Chairman on request.

Attendance at the EGM was down on levels seen at the AGM. Closer inspection of our Articles this morning shows that the meeting was in fact inquorate. Therefore it will be necessary to hold an additional EGM later in the year to ratify the decisions of this meeting.

The Disciplinary Committee was authorised to investigate further the absence of several individuals and to report back in due course.

The formal business of the evening completed, the meeting retired to the excellent surroundings of the Lanesborough courtesy of one our founding shareholders.

Sunday, 10 May 2009

Tuesday, 5 May 2009

Warren Buffet - an interesting insight

Bill Gross - Government intervention in markets will last

A photograph of Bernard Baruch looms ominously on the far corner of my PIMCO office wall. Vested, with pocket watch and protruding chin thrust prominently toward the observer, this well-known financier of the early 20th century at times appears almost alive.

It was Baruch who almost schizophrenically cautioned investors during the stock market’s speculative blow-off in the late 20s that “two plus two equals four and no one has ever invented a way of getting something for nothing.” Three years later during the depths of economic and financial gloom he opined just the opposite: “Two plus two still equals four,” he said, “and you can’t keep mankind down for long.” Homo sapiens, as it turns out, stayed on the deck for much longer than Baruch envisioned – some historians having suggested that it was only war and not the rejuvenating economic spirits of a capitalistic peace that eventually turned the tide – but his words, first of caution and then of optimism, typify the way that fortunes were, and still are, made in the financial markets: Get your facts straight, apply them to the current valuation of the market, take decisive action, and then hold on for dear life as the mob hopefully comes to the same conclusion a little way down the road.

I stare into Baruch’s eyes almost every day – not that we are simpatico or kindred spirits of any sort – but when I do, it’s as if I can hear him almost whispering to me over the portals of time: “Two plus two,” he commands, “two plus two, two plus two.” The message – fortunately, I suppose – ends there. If you thought I was receiving market calls from the ghost of Bernard Baruch I suspect PIMCO would have far fewer clients than we do today. But his lesson nonetheless remains clear: separate reality from exuberance either on the up or the downside and you have the ingredients for a successful market strategy.

Through the years here at PIMCO there have been numerous demarcation points where Baruch’s whispers almost turned into screams. Two plus two screamed four in September of 1981 with long-term Treasury yields approaching 15%, and two plus two boomed four in 2000 when the Dot Coms rose to prices that discounted the hereafter instead of the next 30 years. Similarly, 2007 was a screaming mimi with the subprimes – if only because the liar loans and no-money-down financing were reminiscent of a shell game, Ponzi scheme, or some other type of wizardry that was bound to lead to tears.

2009 is a similar demarcation point because it represents the beginning of government policy counterpunching, a period when the public with government as its proxy decided that private market, laissez-faire, free market capitalism was history and that a “private/public” partnership yet to gestate and evolve would be the model for years to come. If one had any doubts, a quick, even cursory summary of President Obama’s comments announcing Chrysler’s bankruptcy filing would suffice. “I stand with Chrysler’s employees and their families and communities. I stand with millions of Americans who want to buy Chrysler cars (sic). I do not stand…with a group of investment firms and hedge funds who decided to hold out for the prospect of an unjustified taxpayer-funded bailout.” If the cannons fired at Ft. Sumter marked the beginning of the war against the Union, then clearly these words marked the beginning of a war against publically perceived financial terror.

Make no mistake, PIMCO had no dog in this fight, and has infinitesimally small holdings of GM bonds as well. In turn, the rebalancing of wealth from the rich to the “not so rich” is a long overdue reversal, one that I have encouraged in these Outlooks for at least the past several years. But promoting and siding with the majority of the American public in their quest for change does not mean that as investors, we at PIMCO stand star-struck like a deer in front of the onrushing headlights, doing nothing to protect clients. Our task is to identify secular transitions and to preserve and protect capital if indeed it is threatened. Now appears to be one of those moments.

This is a new era of big government and re-regulation. What does all this portend for the economy and investing. Gross says it means slower growth and higher risk premia for financial assets in the U.S. But, Gross does not believe this is a bad thing at all - it is a necessary change

Asia is de-coupling...

Asia has been hard hit by the collapse in global demand largely because of the region’s heavy reliance on exports. Singapore, Hong Kong, Taiwan and Japan are in recession and growth elsewhere is the weakest in years.

"Poverty is worsening in many countries. Businesses are struggling. The extremely urgent climate change agenda could be affected," Indonesian President Susilo Bambang Yudhoyono said at the annual meeting of the Asian Development Bank.

"If all this goes unchecked, down the road we could see social and political unrest in many countries," he told representatives of the ADB’s 67-member countries, including finance ministers and central bank governors.

To counter the downturn, the ADB said it will raise lending by half and Asian governments agreed at the weekend to launch a $120 billion fund countries can tap to avert a balance of payments crisis.

You will recall that the Asians were forced to go cap in hand to the IMF for bailout funds after the Asian Crisis in the late 1990s. This experience was very humiliating for some and caused extreme hardship as the IMF programs were rather severe and deflationary. Resentment toward the IMF remains as a result. I see this development as an explicit measure to exclude the IMF in Asia. I am not the only one who noticed this. Marc Chandler the Chief Global Currency Strategist at Brown Brothers Harriman sent out a missive today titled "The Beginnings of an Asian IMF?" saying:

Back in the 1997-1998 Japan proposed an Asian-based IMF, the US objected and the issue seemed to be closed. However, during this crisis, a modified version appears to be in the works and without the international objections.

ASEAN+3 (Japan, China and South Korea) confirmed over the weekend that a $120 bln fx reserve pool will be established by year-end as the Chiang Mai Initiative is expanded. Participating countries can borrow up to 20% of their quote (agreed upon swap ). The other 80% can be accessed only after an IMF-like agreement. At first multilateral agencies, like the IMF and ADB, will be tapped for their expertise, but the intent to be independent is clear. Over time, their own surveillance unit will identify risks and provide oversight.

Separately, Japan offered a $60 yen-swap facility and to guarantee yen-denominated bonds (samurai) issued by developing countries. This is in addition to contributing $38.4 bln to the reserve pool (the same as China–including HK). South Korea will provide $19.2 bln. The four largest economies in ASEAN–Thailand, Indonesia, Malaysia, and Singapore–will each contribute $4.77 bln each, and the Philippines will pony up $3.68 bln.

Now, you should note that the CLSA China Manufacturing Index for April also came out overnight (see Econompic Data’s charts), with the index registering expansion in China for the first time in nine months. The reading was 50.1 in April versus 44.8 March. This indicates that the stimulus efforts of the Chinese government are indeed having the wanted effect on demand as I suggested last week. Therefore, I am officially abandoning my downbeat forecast for Chinese growth (see my predictions for 2009).

Asia looks poised to break away from the West, dare I say de-couple. I am loathe to use that word because the inter-connectedness of the global economy has meant that negative demand-side shocks in the West will be felt in Asia as well. Nevertheless, Asia looks to be developing an Asia-only dynamic and re-focusing on internal trade and politics. This is good for Asia, but, for the West, not so much.

Source

Friday, 1 May 2009

Treasuries are getting crushed

So, my question is this. Are treasury yields rising because of:

* A reflation play i.e. inflation is coming?

* A recovery play i.e. we are seeing green shoots and that’s bearish for Treasuries?

* A Fed play i.e. Bernanke is not going to do any more quantitative easing, or at least not enough to stop rates from rising?

* A revulsion play i.e. too much debt is being issued?

Irrespective of why yields are rising, it’s not good for a potential recovery

Monday, 27 April 2009

Hardy Guevara

Friday, 24 April 2009

Everton FC - back to Wembley

Here's the penalty shootout against United on Sunday

Chelsea - you're next!!!!

Wednesday, 15 April 2009

Green shoots over thin ice

Thus far, we’ve got a strong rally off the recent trough, with uninspiring sponsorship but good breadth, reasonable but not strikingly attractive valuations, and an overhang of increasingly distressed mortgage and non-residential debt that looks like Armageddon Part II in the offing, because we are doing nothing to restructure it. In my view, the recent advance looks not like a garden of “green shoots,” but very much like a short-squeeze off of an oversold trough. It would be convenient if such bounces could be predicted in advance, but as we observed last year, the market can become very persistently oversold during bear markets, and even an “oversold” decline can go much deeper until the oversold condition is abruptly cleared.

Fundamentally, my view is that the U.S. economy is on very thin ice, and that by focusing on the bailout of corporate bondholders rather than the restructuring of debt, we are courting the risk of a far deeper downturn. Last year, I didn’t think it was conceivable that policy-makers would attempt to address this problem by making lenders whole with public funds. This is an ethical abomination, putting the public in the position of absorbing the losses that should properly be borne by those who provided capital to these institutions. It is not sustainable. What it does it place the public in the position of losing first, but it will not, and cannot prevent the ultimate failure of the debt – for the simple reason that without restructuring, the debt can’t be serviced.

It is true that insurers, pension funds, and other entities own part of the debt of these financial institutions, but they certainly do not own all of it, and to the extent that it is in the public interest to use public funds to reimburse the losses of various entities, that can and should be part of the political process. But to broadly immunize every bondholder of these institutions with public funds is repulsive. Even the bondholders of Bear Stearns can expect to get 100% of their principal back, with interest.

Aside from the abuse of the public trust inherent in these bailouts, it is also offensive to anybody who devotes a significant portion of their income to charity, because there are so many better uses for trillions of dollars. Think about it. Two of the wealthiest people on earth, Warren Buffett and Bill Gates, after lifetimes of work, will be able to commit a combined total of about $100 billion to charity. But that figure is dwarfed by the amount being allocated to protect corporate bondholders from taking a “haircut” on distressed debt, or swapping a portion of it for equity – both perfectly appropriate ways of compartmentalizing the losses of these financial institutions, without public funds, and without receivership or “nationalization.”

Friday, 10 April 2009

Reds in the Red

Manchester United has increased full-year sales by 22 per cent to £256.2 million, a record for a British football club. That means profits, before interest and taxation, at Red Football Limited, United's immediate parent, rose by 29 per cent to £24.1 million.

The figures cover the 12 months to the end of June last year, taking in the whole of the 2007-08 season, during which United won the Uefa Champions League and, for the tenth time, the Premier League title.

However, once interest payments of £45.5 million were applied, Red Football Limited made a pre-tax loss of £21.4 million — down from a loss of £24.3 million in the previous year.

Meanwhile, Red Football Joint Venture — the vehicle through which Malcolm Glazer, the US tycoon, and his family bought United and which is the club's ultimate parent — reported a pre-tax loss of £44.8 million, mainly because of interest payments. That rose during the period from £604 million to £649.4 million because of the way that interest on “payment in kind” loans continued to roll up. Piks are loans on which no interest is payable until the end of the loan term.

United's turnover was up sharply in all three of its main areas, with matchday receipts rising by 10 per cent to £101.5 million, while commercial income — which takes in merchandising, sponsorship and licensing agreements - rose by 14 per cent to £64.0million. The biggest increase was in TV revenue which, on the strength of United's Champions League triumph, surged 48 per cent to £90.7 million.

The sale of players, including Giuseppe Rossi, Gerard Piqué, Chris Eagles and Gabriel Heinze, boosted profits by £21.8million.

The club made new commercial partners during the year, including Saudi Telecom and Diageo, while existing partnerships with Budweiser, Travelcare and GlaxoSmithKline were renewed.

Monday, 6 April 2009

Tropicana Line's Sales Plunge 20% Post-Rebranding

Interesting article on how a disastrous re-branding of Tropicana's famous "orange with a straw" caused sales to plunge 20% in less than 7 weeks:

from adage.com

NEW YORK (AdAge.com) -- Tropicana's rebranding debacle did more than create a customer-relations fiasco. It hit the brand in the wallet.

The new Tropicana Pure Premium packaging had been on the market less than two months before the company scrapped the redesign.

After its package redesign, sales of the Tropicana Pure Premium line plummeted 20% between Jan. 1 and Feb. 22, costing the brand tens of millions of dollars. On Feb. 23, the company announced it would bow to consumer demand and scrap the new packaging, designed by Peter Arnell. It had been on the market less than two months.

A swift reversal

Now that the numbers are out, it's clear why PepsiCo's Tropicana moved as fast as it did. According to Information Resources Inc., unit sales dropped 20%, while dollar sales decreased 19%, or roughly $33 million, to $137 million between Jan. 1 and Feb. 22. Moreover, several of Tropicana's competitors appear to have benefited from the misstep, notably Minute Maid, Florida's Natural and Tree Ripe. Varieties within each of those brands posted double-digit unit sales increases during the period. Private-label products also saw an increase during the period, in keeping with broader trends in the food and beverage space.

Friday, 3 April 2009

Alan Whicker Island

Here's Monty Python's classic "Whicker" sketch:

Wednesday, 1 April 2009

9 Billion - The World Population in 2050

The data is available here

Tuesday, 31 March 2009

Pimpthisbum.com.......

Does panhandling work better through the web? A Houston father and son team thinks so. They gave a homeless man named Timothy Dale Edwards a sign to hold while panhandling; it directed passersby to his website, PimpThisBum.com. In less than two months, the site has garnered $50,000 in pledges and donations. The project’s creators believe its success has to do with the sign’s humor and the faux-tactless domain name.

We’d like to suggest another reason: appeals for money encouraging credit card use are far more effective than appeals calling for cash, according to a recent study

(If you haven't the time to read it, it essentially demonstrates that people will pay more for a product or service with a credit card than when using cash...... )

Friday, 27 March 2009

The Fraser Institute is offering a $1,000 top prize for proposals on what economic or public policy issue it should try to measure. More information is here. Submit a brief essay or video with a clear thesis on what should be measured, why it should be measured, and how it might be measured.

Thursday, 26 March 2009

China's Way Forward

China's Way Forward

Idle factories, moored container ships, widespread bankruptcies, massive migration back to the hinterlands, strangely clean air—the signs of depression are everywhere in China. Because it makes so many of the goods the world isn’t buying now, China stands to be worse hit than the rest of the world —just as America was during the Depression, when it was the world’s sweatshop. But like America then, China will use tough times to design innovative products that will get it the high profits and the high-value jobs Americans kept to themselves for decades. And that is very bad news for the United States, unless it uses tough times to reinvent itself, too.

Wednesday, 25 March 2009

Top of the Gilt/Bond market?

Bernanke's purchases could be the mirror image of Gordon Brown's decision to sell gold at the bottom of that market in 1999.

Goldman: Quote of the day - “Leopards change spots”

by Edward Harrison

If you haven’t noticed, I think the Geithner Plan, while far from perfect, has a reasonable chance of success. Marshall, too, believe the plan work as he has suggested in his last post. The optics of it are another matter.

“Goldman has already said they will repay their TARP money within a month (obviously all of this negative press scrutiny is getting to them). Easy enough to do: they’ve had billions funnelled to them via AIG, so they can now take that money and “repay” TARP. Nice circular shell game.

And that’s how the Geithner plan will work as well. They’ll all be bidding for each other’s assets at vastly inflated prices, getting a good “mark” on their books and then they’ll dump the crap with the taxpayer. I actually think the plan will work because it’s officially sanctioned larceny. It’s just like me saying, I could get rich if the government gave me the means to rob banks every time I needed money.

Is this a great country, or what?”

The money quote, however, comes from Thomas Ferguson, a well-known professor at UMass-Boston:

“Leopards change spots with amazing celerity when it pays. By the way, I think the next step is pretty obvious with the banks and the US government this morning. Institutions that get rid of toxic assets thanks to the new Geithner plan will then forthwith pay back their TARP loans. Indeed, if they are confident of their refinancing, then they may do it without participating in the program. That way they escape the constraints, and get money. So much for exec comp issues.

Sort of like the original TARP plan as Paulson and Bernanke hatched it.

How about that for history proceeding in spirals, rather than straight lines?”

Tuesday, 24 March 2009

An ode about Bernie Madoff

There once was a fund guy called Bernie,

Whose clients had one hell of a journey

They invested in trust

Found out it was bust

And then they all ended up on a gurney

Friday, 20 March 2009

President Obama on the Tonight Show with Jay Leno

The full transcript is available here

Thursday, 19 March 2009

Norway’s krone: the new safe haven currency?

The Swiss National Bank’s decision to intervene to weaken the franc has left currency investors with one less haven from the financial crisis.

Its move comes at a time when there are also questions surrounding the future haven status of two other leading currencies: the dollar and the yen.

While the dollar has enjoyed a liquidity premium amid the current financial turmoil, many investors expect it to lose its allure as the full impact of large-scale US fiscal and monetary loosening filters through.

Simon Derrick at Bank of New York Mellon says: “The dollar has clearly been supported by haven flows during the current crisis.

“But, in the longer-term, the sheer scale of US fiscal spending and the lack of international capital available to support it represents a direct threat to the dollar’s strength.”

The Swiss franc has been driven lower by the SNB, which last week intervened to sell the currency, saying its recent appreciation represented an unwelcome tightening in monetary conditions.

Meanwhile, the yen has been undermined by a series of data showing a steep downturn in Japan’s export-driven economy.

This has helped stoke expectations that the Bank of Japan will follow the SNB and intervene to weaken its currency.

So where do currency investors turn now? One answer could be Norway.

David Bloom at HSBC says “The ultimate haven currency in our view is the Norwegian krone. “It’s probably the best currency in the world.”

“It’s probably the best currency in the world”

This might seem surprising. Only last December the krone dropped to a record low against the euro, as falling oil prices took their toll on the currency. But, as crude prices have stabilised, the oil producer’s currency has fought back strongly.

Indeed, the krone is one of the few currencies that has outperformed the dollar so far this year, rising more than 3 per cent to NKr6.694. It has soared 11 per cent to NKr10.925 against the euro.

Mr Bloom says: “The Norwegian krone is our preferred major currency and we expect a sustained appreciation over the next 18 months.”

Analysts say on a number of measures, the krone is near or at the top of the league among the world’s 10 most traded currencies.

Norway’s economy grew 1.3 per cent in the fourth quarter of last year and is not forecast to experience as big a downturn as most other leading economies this year.

Monetary policy is also supportive of the krone, with the Norges Bank, Norway’s central bank, like those in other commodity-producing countries such as Australia and New Zealand, not expected to resort to quantitative monetary easing to boost inflation expectations. The country also has a large current account surplus.

The cost of insuring against sovereign default in Norway through credit default swaps is the lowest among the countries with the ten most traded currencies.

Mr Bloom says that if the stock of assets Norway has salted away from its oil revenues in the Government Pension Fund of Norway is added to the mix, the bullish story for the krone is complete.

But some analysts are less glowing about the krone’s prospects.

Gavin Friend at NAB Capital agrees the krone appears one of the best of a bad lot, with a healthy current account balance and interest rates likely to lend it support.

But he says: “You are trying to win the least ugly currency contest at the moment. I can’t disagree that it might move higher, but I can’t get too enthusiastic.”

His main concerns are the lack of liquidity in the market and the krone‘s long-held correlation with oil prices.

“I struggle to see how the Norwegian krone can outperform for a sustained period if oil prices remain low,” he says.

Ashraf Laidi at CMC Markets says the fact that the krone fell against both the dollar and the euro during the turbulence following the collapse of Lehman Brothers in September means it cannot really be called a haven currency.

But he believes that the krone, along with the Australian dollar, is ideally positioned for prolonged gains as risk appetite improves.

He says the Australian dollar represents an economy with a superior growth outlook. The country’s budget surplus is expected to hover at 1 per cent of gross domestic product – which compares with the deepening deficits of the US, Europe and Japan.

He says: “The krone has the upper hand as its structural situation is boosted by a hefty current account surplus standing at 5 per cent of GDP – the biggest in the industrialised world”.

Wednesday, 18 March 2009

Ship in "beauty dis-advantaged girls" !

The mayor of an isolated town in Queensland, Australia, was vilified for making the following statement: “May I suggest that if there are five blokes to every girl, we should find out where there are beauty-disadvantaged women and ask them to proceed to Mt. Isa.”

He is simply recognizing that in the dating/marriage markets looks are one of the commodities traded; and there is substantial evidence, for example, here suggesting that uglier women marry men with less human capital, ie men who can earn less. That the mayor is asking ugly women to come to Mt. Isa is just an attempt to get them where their scarcity might allow them to mitigate their “disadvantage” and benefit from the surplus of single men.

Gains from trade of course, make sense, although the mayor’s statement is somewhat crude. Interestingly, the head of the Chamber of Commerce noted that, “There’s a lot of anger circulating among the community… there’s a lot of women voicing their opinions.”

I wonder if the women’s anger is at the mayor’s crudeness, or whether it is a standard response by monopolists who are threatened with competition??

Best Business Blog Award Winner 2008 ( and Cramer v Stewart)

It's an interesting site, run by Dr Patrick Byrne and it sells itself as "a work of investigative journalism examining the growing threat to our financial system posed by illegal naked short selling, stock manipulation, and the destruction of public companies."

In the course of reading through its' content, I came across Jim Cramer, who becomes a central character in Dr Byrne's writings.

Jim Cramer is, of course, the star presenter of CNBC's Mad Money . Most recently he's had a series of run-ins with Jon Stewart on The Daily Show, see the video below:

Tuesday, 17 March 2009

The philanthropist Paul Newman

Paul Newman will always be best known for his work as an actor. But since 1982, he also made his mark as an entrepreneur with his Newman’s Own line of food products. A company that started as a joke between two friends, and never expected to turn a profit, has turned into a fixture in supermarkets around the world. Newman’s Own found its success from accessing a niche market that had been under-serviced. The food products they provide are created with organic ingredients – a strategy which hardly seems revolutionary today, but in the 1980s, was somewhat novel.

In addition Newman discreetly marketed the fact that buying into the Newman’s name would mean that you were contributing to a charity. The novelty of this approach certainly drew some customers in, just as the organic ingredients did. Starting with salad dressing and branching out to a variety of foods, Newman’s Own generated over $250 million in profits in its first two and a half decades.

What makes Newman unique among entrepreneurs is that he then donated all of that wealth to charity. So although Newman was creating wealth, he was not creating it for himself, instead giving it directly to others.

No sign of economic recovery in next 3 or 4 years?

Woodford, who runs the £5.3 billion Invesco Perpetual Income and £7.3 billion Invesco Perpetual High Income funds, said he did not believe there were any 'green shoots' around, nor that there would be any in the near future.

He said: 'I think we are in a pretty difficult environment globally and the UK and the US are having a particularly difficult time. The unsual characteristic of this crisis is that it has been running for such a long time and we are unlikely to see any economic recovery soon.'

'My view is that this is going to go a lot longer than the second half of this year. This crisis will encompass a long adjustment...the scale of debt build up is unprecedented. The process of rebalancing the world economy will take many years. We could be in a weak economic environment for three or four years.

'I don't expect to see a sustained growth in this economy or in America for a significant time, three or four years'.

Over the past three years, Woodford has returned -6.1% with the High Income fund and 6.9% with the Invesco Perpetual Income fund while the FTSE All Share TR benchmark fell 27.2% during that period.

From Citywire

Guess where we are now?

Monday, 16 March 2009

A snapshot around the world

GERMANY: “While everyone is talking about the economic crisis, its direct impact hasn’t arrived here yet. For me, nothing has changed at all.”

SWEDEN: “Living in Gothenburg, the economic crisis has struck the city really hard. Since VOLVO is a big employer here, almost everyone you meet knows someone who has been affected by their cutting back. I see people around me who decided to sell their houses etc. since they can´t afford living there on a reduced salary.”

SPAIN: “In Spain the crisis is being especially intense because a great deal of our economic growth was based on construction. Since getting a mortgage or credit line now is much harder, construction is totally down and unemployment is rising to 20% and above. Fortunately, people around me do not depend directly on construction and no serious effects are seen between friends and family, although everybody is concerned and worried with the unstoppable unemployment rate and the trend is to spend as little money as possible just in case they lose their jobs.”

NORWAY: “Not much has happened here. Those who have stocks have lost half of their money. That’s all. Nobody I know have lost their jobs in Norway. It costs more to rent an apartment than ever. I’m working more than normally in order to prepare for bad days.”

JAPAN: “About the economic crisis, nobody has been laid off within my family or among my friends fortunately, but the owner of an Indian restaurant I go often told me that the economic crisis certainly affected to their business since there are fewer customers after the collapse of Lehman Brothers. On the other hand, there are flash benefits to be paid (12,000 yen) by the government within a month, so my mother for example, is looking forward to buy a Blueray player with it.”

INDONESIA: “People in my local region (Indonesia) are not much affected by the economic crisis that has occurred in USA. The situation is still tolerable and the effects not too significant. We were currently focusing on the political campaigns for the upcoming general election :-)”

POLAND: “My personal view - one with which most people disagree - it that it is mostly panic.”

BRAZIL: “I have a regular job (as a programmer) in an advertising agency. People usually say that when things get rough, the advertising budget is one of the first things to get cut. Not from what I’m experiencing. My agency is acquiring more clients than ever since I’ve been there, and hiring new people all the time. None of my friends are suffering any side effects from the so-called crisis either. My father runs his own thriving business as well, a marina. You’d think that during a crisis people would give up their high-priced luxuries such as boats, but again, that’s not what we observed. He’s been so busy lately with the summer and all that I barely even saw him during these last few months, except for Christmas and New Year’s.”

LATVIA: “Everything’s just peachy. The government resigned last week. The new prime minister just made an announcement on his new government a few hours ago. Inflation rate hit 15.4 % in 2008 and the VAT has been raised to 21% since January 1st. Prices rise so fast you can actually see the difference from one month to another. I guess the economic and financial crisis is everywhere. I miss living in the US.”

RUSSIA: “I am not affected by the local brainwashing mass media. As far as I know, TV broadcast programs or any other mass media sources, including newspapers or radio shows, are trying to blame the US for the crisis (as if the cold war is back again) to distract people from the predicament in Russia - though it’s not a secret to anyone that the inflation rate (not the official number) is over 200% for the past year. … I see prices rising by a ruble for every small article of food every month. … The xenophobic nature, as well as envy of most people make them rebuke others, mostly the US, for the crisis. Which I can understand - people usually are conformists by nature and they repeat whatever they hear from the masses or the mass media. I, personally, blame no one for the crisis, every country had a large role in contributing to it. And I have no doubts that the larger portion might have come from Russia itself.”

source: Apogee Communications

Friday, 13 March 2009

Will the swiss sail on QE2 ?

Apparently, the Swiss franc is too high — or so says the Swiss central bank. As a result, they are selling francs in the foreign exchange market to get the franc to come down. There has been a lot of speculation about the Swiss and their plans to devalue the Swiss franc, including on this site. It now seems clear that devaluation is where things are headed. Quantitative easing (QE) may be next.

The Swiss are not a member of the Eurozone. They are not even a member of the EU. Like Norway (and Iceland, for that matter), the Swiss are on their own. This has benefits. The Impossible Trinity is a non-sequitur. One can print money and devalue at the heart’s content. The Brits have shown us the power of devaluing a currency from 2.11 per U.S. Dollar to 1.43 per U.S. Dollar. Surely, the Swiss can do the same. In fact, in the case of the Swiss, devaluation would mean that their debtors will be able to repay their loans more easily. I fully expect the Swiss National Bank understands this and is prepared to crank up the presses if they have not begun to do so already.

Just the other day, the Brits started quantitative easing a.k.a. printing money — joining the Americans and the Japanese in plucking bills off the money tree at the central bank.

Who’s next to get on the QE2 - its a lovely ship? Why, Switzerland, of course.

The Swiss franc plunged to its lowest level so far this year on Thursday after the Swiss National Bank said it was set to make purchases in the foreign exchange market to halt the currency’s rise against the euro.

The Swiss franc’s haven status has been heightened by the recent market turmoil and seen it rise 9 per cent on a trade-weighted basis since July and come close to its record high around SFr1.43 against the euro in recent weeks.

The SNB said the Swiss franc’s strength represented an “inappropriate tightening of monetary conditions” as it battled against a sharp deterioration in the Swiss economy.

“In view of this development, the SNB has decided to purchase foreign currency on the foreign exchange market to prevent any further appreciation of the Swiss franc against the euro,” the central bank said.

The central bank said it had implemented its decision, with traders confirming that the SNB had been active in the market.

This represented the first time a major central bank has intervened in the foreign exchange markets since 2004 when the Bank of Japan sought to weaken the yen.

The Swiss franc dropped 3.2 per cent to SFr1.5290 against the euro and dropped 3.7 per cent to $1.1952 against the dollar.

Marc Chandler at Brown Brothers Harriman said even though the SNB’s intervention to weaken the franc was enjoying immediate success, the policy’s longer term prospects were more questionable.

But do the Swiss have any choice? The Swiss are going to do QE too.

“The SNB is certainly next in line for such moves,” said Jan Amrit Poser, chief economist at Bank Sarasin in Zurich. “The SNB probably needs to do more. It’s game over for conventional monetary policy.”

Thursday, 12 March 2009

When is a pint not a pint?

Sometimes even the smartest companies do really dumb things....

In the US, Haagen-Daz have reduced the size of their pint of ice cream from 16 oz to 14 oz citing "Over the past few years, the cost of all-natural ingredients, like fresh eggs, top-quality raspberries and Madagascar vanilla, has increased by an average of 25%. The energy required to make and deliver our products has risen in cost as well, despite the recent dip in gasoline prices"

However one company's PR disaster is another's opportunity. Ben and Jerry's stated thus:

"One of our competitors (think funny-sounding European name) recently announced they will be downsizing their pints from 16 to 14 ounces to cover increased ingredient and manufacturing costs and help improve their bottom line," the statement said.

"We understand that in today's hard economic times businesses are feeling the pinch. We also understand that many of you are also feeling the same, and think now more than ever you deserve your full pint of ice cream."

Wednesday, 11 March 2009

Yes, we're in a depression

Here's a couple of excerpts:

The world’s banking system collapsed last fall, was placed on life support at a cost of some trillions of dollars, and remains comatose. We may be too close to the event to grasp its enormity. A vocabulary rich only in euphemisms calls what has happened to the economy a “recession.” We are well beyond that. We are in the midst of the biggest economic crisis since the Great Depression of the 1930’s. It began as a recession — that is true — in December 2007, though it was not so gentle a downturn that it should have taken almost a year for economists to agree that a recession had begun then. (Economists have become a lagging indicator of our economic troubles.)

That last line about economists is pretty biting, and not very arguable.

Here’s a bit more on Posner’s decision to call the current crisis a depression:

The word itself is taboo in respectable circles, reflecting a kind of magical thinking: if we don’t call the economic crisis a “depression,” it can’t be one. But no one who has lived through the modest downturns in the American economy of recent decades could think them comparable to the present situation. … It is the gravity of the economic downturn, the radicalism of the government’s responses, and the pervading sense of crisis that mark what the economy is going through as a depression.

Reproduced from the freakonomics blog

Monday, 9 March 2009

Blackberry Ad - Effective or not?

This 17 second "viral" ad appeared on youtube at the end of February. In its' first week it had more than 500,000 viewers and appeared on more than 180 blogs.

In my opinion, very effective!

Saturday, 7 March 2009

Michael Lewis on Iceland

Demonstrators in front of Iceland’s parliament building, in Reykjavík’s Austurvollur Square, on January 31.

Photographs by Jonas Fredwall Karlsson.

Iceland’s de facto bankruptcy—its currency (the krona) is kaput, its debt is 850 percent of G.D.P., its people are hoarding food and cash and blowing up their new Range Rovers for the insurance—resulted from a stunning collective madness.

What led a tiny fishing nation, population 300,000, to decide, around 2003, to re-invent itself as a global financial power?

In Reykjavík, where men are men, and the women seem to have completely given up on them, the author follows the peculiarly Icelandic logic behind the meltdown.

by MICHAEL LEWIS April 2009

The full article is here

Friday, 6 March 2009

Knowing your audience.....

First poster: A man lying in the hot desert sand...totally exhausted and fainting.

Second poster: The man is drinking our Cola.

Third poster: Our man is now totally refreshed.

And then these posters were pasted all over the place. "Then that should have worked!" said the friend. "It should have!?" said the salesman. "But I didn't realize that Arabs read from right to left!!"

Thursday, 5 March 2009

Are we right to demand our kids to work harder?

I was impressed but also horrified in equal measure, to learn that Obama's mother had him up at 4.30 most mornings to go through his lessons. The video clip is below:

Elsewhere, Malcolm Gladwell (the author of The Tipping Point and Blink) has written a new book, Outliers, The stories of success.

In the book he describes the success that the Chinese as a race have, in part, is down to the more readily accepted hard work ethic. He quotes a Chinese Proverb:

No one who can rise before dawn 360 days a year fails to make his family rich

He argues that the greater the opportunity for hard work, for example longer school hours and more home study, the greater the opportunities for success later in life.

I'd be interested in anyone's thoughts and comments

Wednesday, 4 March 2009

Tuesday, 3 March 2009

Monday, 2 March 2009

A prophecy from 1867

Owners of capital will stimulate the working class to buy more and more of expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable.

The unpaid debt will lead to bankruptcy of banks, which will have to be nationalised, and the State will have to take the road which will eventually lead to communism

Quantifying the Nightmare Scenarios

Quantifying the Nightmare Scenarios

By Eric Zitzewitz

There’s no shortage of fear about the economy. But just how fearful should we be? Perhaps financial markets can provide some guidance.

There’s a neat mathematical trick, by which we can use option prices to quantify the probability of the stock market falling by various amounts. Breeden and Litzenberger (1978) show that by comparing the prices of options at adjacent strike prices, you can calculate the approximate value of securities that would pay $1 if the underlying stock traded in a certain range on expiry day.

(Economists know these as Arrow-Debreu securities; they approximate what option traders call “butterfly spreads” when strike prices are close together.)

“Option prices suggest that there is a very real chance of, dare I write it, another Great Depression.”

For example, using last Friday’s options prices, we can calculate that it would cost 10 cents to buy a portfolio of options that pays $1 if the S&P 500 falls below 250 on December 18, 2010. If markets were risk-neutral (I’ll come back to this), we could infer that the market thought there was a 10 percent probability that the value of U.S. stocks could fall to one-third their current value by the end of next year. Such a drop would leave the index down to one-sixth of its peak level in late 2007. By way of comparison, in the Great Depression the value of stocks fell to between one-sixth and one-seventh of their earlier values.

Here is a graph of the probability distribution for the value of the S&P 500 in December 2010 — as implied by the options markets. The red line uses option prices from the end of September 2008 (after Lehman’s collapse); the blue line uses prices from Friday. As you can see, the probability of a substantial drop in the value of stocks has moved from relatively remote to quite substantial. Not only has the distribution shifted to the left, but the left tail has gotten thicker, suggesting there’s much more concern about extremely bad outcomes. (The dashed line indicates where I have used the pricing of the last two options to infer prices of options that are further out of the money.)

This graph yields a pretty interesting story. The most likely scenario is the S&P 500 ends in 2010 between 800 and 1,000, which is up 5 percent to 30 percent from today. But today’s market is being held down by the prospect of a Depression-like decline in stocks.

What do these bad-news scenarios look like? Surely the value of financial firms would be zero, but as these are only around 10 percent of today’s index, the dismal outcomes must be more widespread. Profits would have to fall significantly, with little hope of medium-term recovery. Such a decline in profits would go hand in hand with a sustained decline in incomes across all sectors.

There’s an important caveat to all this. Even when the market price of a bundle of options paying $1 if “the S&P 500 is below 250 in December 2010″ costs 10 cents, we cannot infer that there’s a 10 percent chance of this happening. Since this security would help hedge against extreme wealth losses, investors should be willing to pay an insurance premium. Furthermore, the investors buying these securities could be panicking and overpaying for them, and the more sanguine may be unable to offset this fear if their money is tied up elsewhere.

Regardless of whether it reflects risk aversion, panic, or a true probability, the 10 cent price being paid for a dollar of Depression insurance highlights the fears that are holding stocks down. Policymakers have been trying to reassure investors that they understand the risks of depression and will do what is needed to avoid them. These graphs provide a measure of how far they have to go in convincing us.

Will Social Networks On the Web Ever Make Money?

Interesting article from Forbes, about the ability (or not) of Facebook, Linkedin, Twitter etc to turn their fast number of users into cash generators.

In the last week or so, there have been a number of events that bring up the big question: Will Web-based social networks ever become significant businesses? Or, put another way: Do these social networks--Twitter, Facebook, LinkedIn, MySpace--have the ability to "monetize" their audiences?

My answer: While today, these may not look like great businesses (which hasn't stopped investors' willingness to fund them), I'm convinced that the daily interactions of their vast memberships--and their users' willingness to share their interests, tastes, relationships and intentions, and the massive amounts of data around users' behavior--will eventually lead to substantial revenues and profits. But I don't think that those revenues will come just from the Web advertising standards of banners and contextual search links.